Your Derecognition of property plant and equipment images are available in this site. Derecognition of property plant and equipment are a topic that is being searched for and liked by netizens today. You can Get the Derecognition of property plant and equipment files here. Find and Download all royalty-free vectors.

If you’re looking for derecognition of property plant and equipment images information connected with to the derecognition of property plant and equipment keyword, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

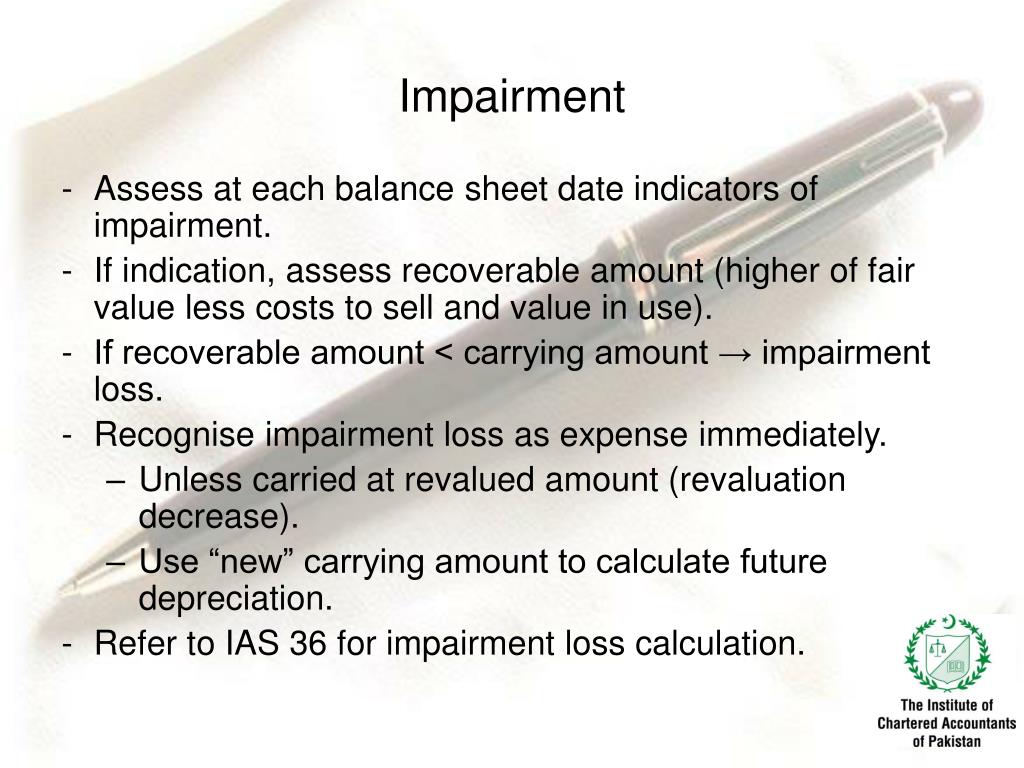

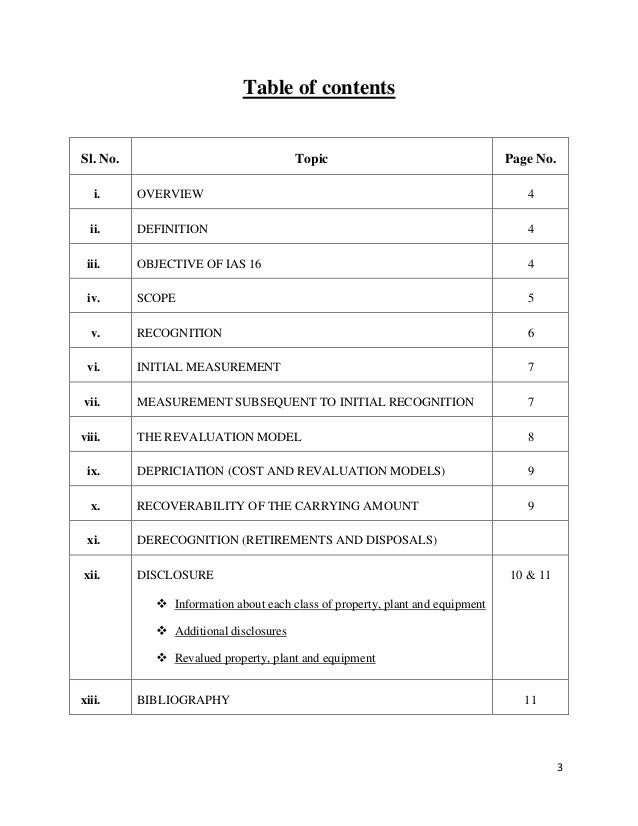

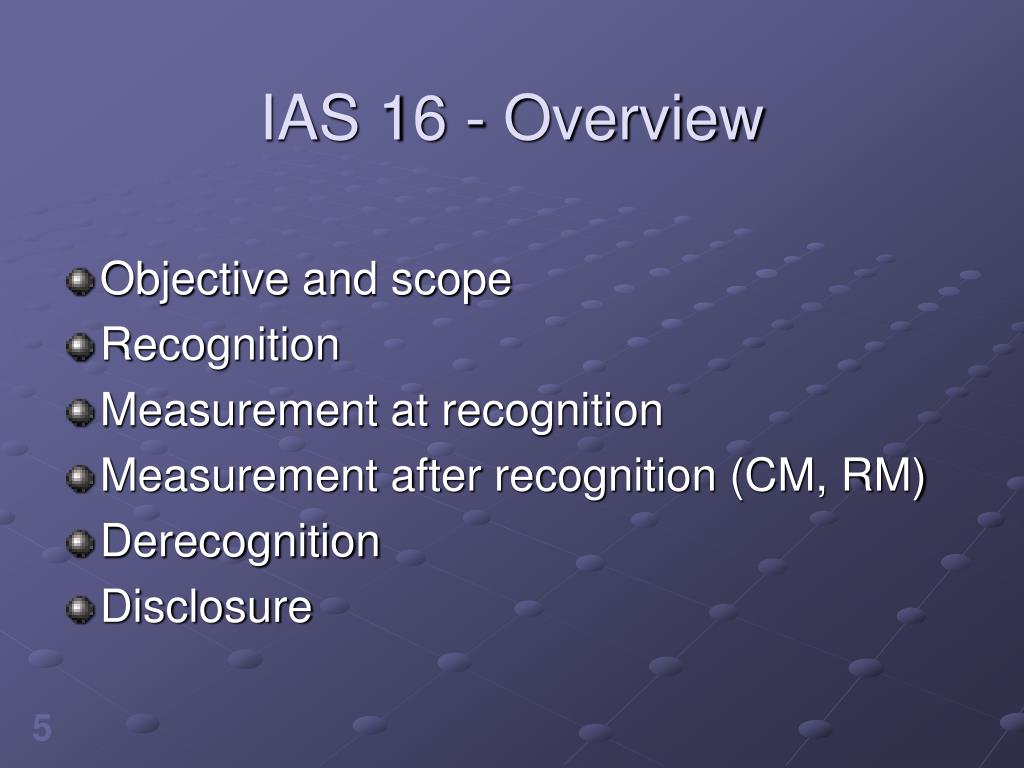

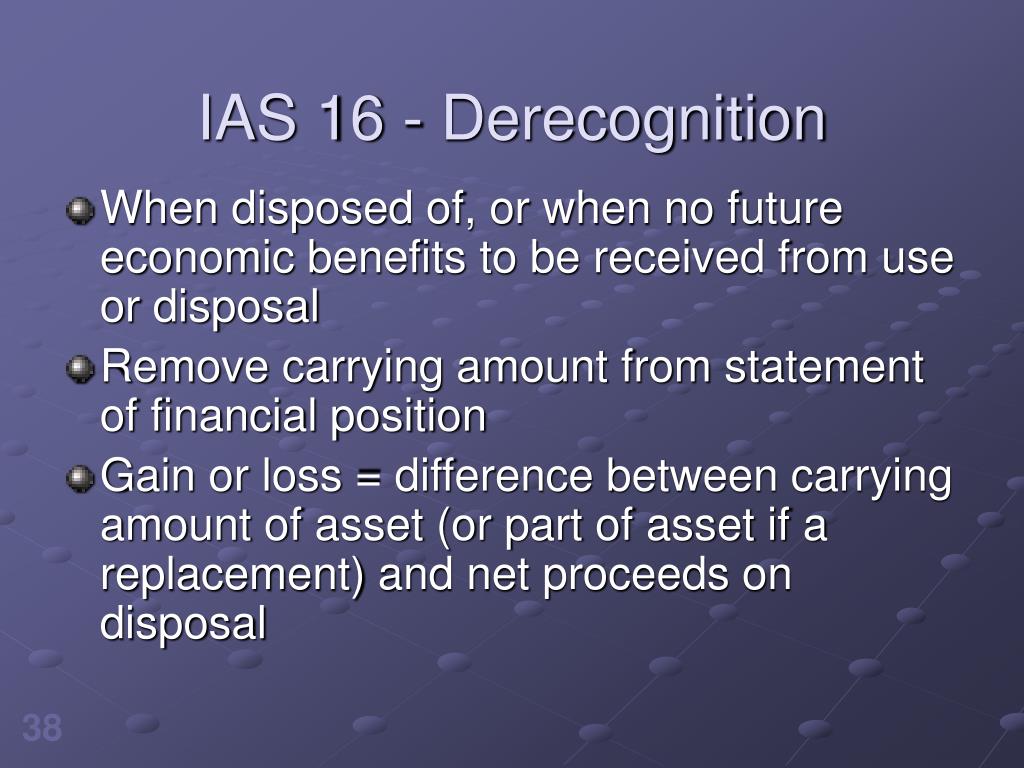

Derecognition Of Property Plant And Equipment. An item of property, plant, or equipment shall not be carried at more than recoverable amount. A gain or loss on disposal is recognised as the difference between the disposal proceeds and the carrying amount of the asset at the date of disposal. Ias 16 property, plant and equipment requires impairment testing and, if necessary, recognition for property, plant, and equipment. Property, plant and equipment tangible items that are:

PPT Property, Plant and Equipment IAS 16 PowerPoint From slideserve.com

PPT Property, Plant and Equipment IAS 16 PowerPoint From slideserve.com

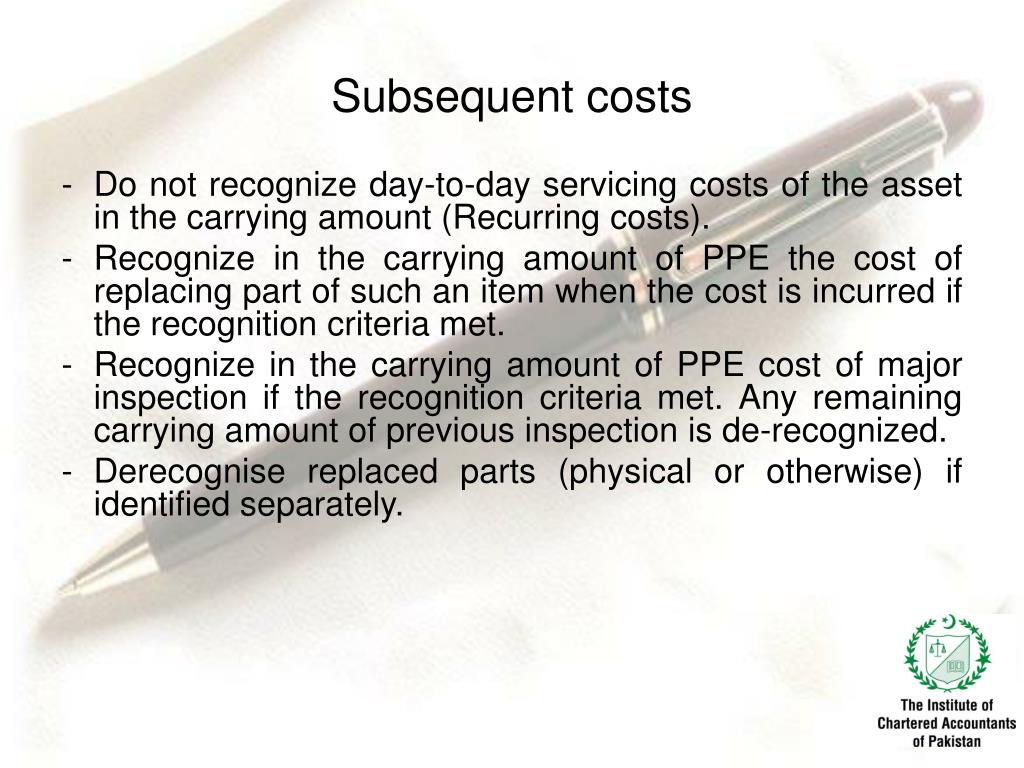

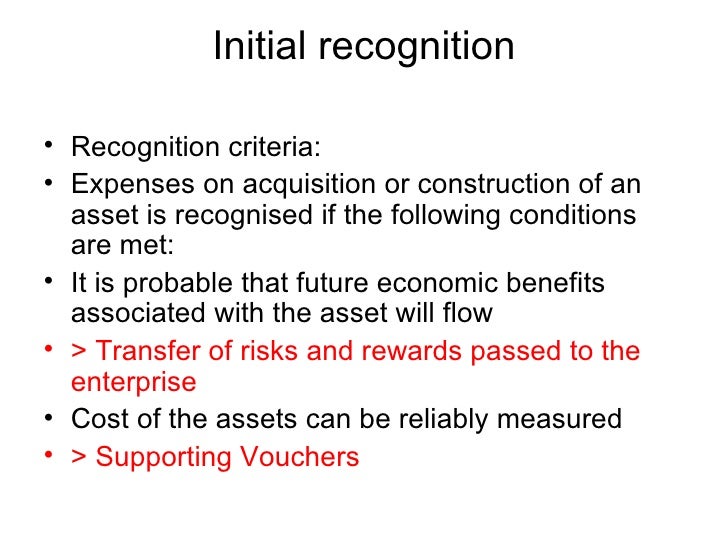

An item of property, plant, or equipment shall not be carried at more than recoverable amount. 7 derecognition of asset 7.1 when derecognition occurs? Property, plant, and equipment (for example, real estate) that is within the scope of topic 360. Derecognition derecognition means that the cost of the property, plant and equipment together with the related accumulated depreciation shall be removed from the statement of financial position. Under the recognition principle in paragraph 7, an entity recognises in the carrying amount of an item of property, plant and equipment the cost of replacing part of such an item when that cost is incurred if the recognition criteria are met. Recognition of property, plant and equipment.

The gain (not classified as revenue!) or loss arising from the derecognition of an item of property, plant and equipment shall be included in profit or loss when the item is derecognized.

Any cost directly attributable in bringing the asset to the location and condition for the intended use d. Therefore, an entity would look to the definition and indicators of control in the proposed revenue recognition guidance to determine when the counterparty to the transaction obtains control of the asset (that is, real estate) and when to derecognize the real estate. Derecognition the carrying amount of an item of property, plant and equipment shall be derecognized: Property, plant, and equipment (for example, real estate) that is within the scope of topic 360. Any cost directly attributable in bringing the asset to the location and condition for the intended use d. Explain and evaluate how impairment, revaluation, and derecognition of property, plant, and equipment and intangible assets affect financial statements and ratios;

Source: chinese.iamdelusionman.com

Source: chinese.iamdelusionman.com

Disposal (such as sales) when no future benefits are expected from its use or sale i.e. The gain or loss from the derecognition is calculated as the net disposal proceeds (usually income from sale of item) less the carrying amount of the item. Determination of their carrying amounts, and the depreciation charges and impairment losses to be recognized in relation to them. The gain or loss from the derecognition of an item of property, plant and equipment shall be included in profit or loss. The gain (not classified as revenue!) or loss arising from the derecognition of an item of property, plant and equipment shall be included in profit or loss when the item is derecognized.

Source: slideserve.com

Source: slideserve.com

An item of property, plant, or equipment shall not be carried at more than recoverable amount. Therefore, an entity would look to the definition and indicators of control in the proposed revenue recognition guidance to determine when the counterparty to the transaction obtains control of the asset (that is, real estate) and when to derecognize the real estate. Property, plant and equipment tangible items that are: Under the recognition principle in paragraph 7, an entity recognises in the carrying amount of an item of property, plant and equipment the cost of replacing part of such an item when that cost is incurred if the recognition criteria are met. The gain or loss from the derecognition is calculated as the net disposal proceeds (usually income from sale of item) less the carrying amount of the item.

Source: studylib.net

Source: studylib.net

Disposal (such as sales) when no future benefits are expected from its use or sale i.e. An item of property, plant, or equipment shall not be carried at more than recoverable amount. Explain the derecognition of property, plant, and equipment and intangible assets; Derecognition of property, plant and equipment=====please like, share, and subscribe to my channel, so. Any cost directly attributable in bringing the asset to the location and condition for the intended use d.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

- the gain or loss arising from the derecognition of an item of property, plant and equipment shall be determined as the difference between the net disposal proceeds,. To account for the disposal of a. Property, plant, and equipment (topic 360) derecognition of in substance real estate— a scope clarification a consensus of the fasb emerging issues task force this exposure draft of a proposed accounting standards update of topic 360 is issued by the board for public comment. The cost of an item of property, plant and equipment comprises all of the following, except a. 67) the gain or loss arising from the derecognition of an item of property, plant and equipment shall be determined as the difference between the net disposal proceeds,.

Source: slideserve.com

Source: slideserve.com

Disposal (such as sales) when no future benefits are expected from its use or sale i.e. As a result, the asset is removed from the financial statements. Initial estimate of the cost of dismantling and removing the item and restoring the site, the obligation. Ppe should be derecognised (removed from ppe) either on disposal or when no future economic benefits are expected from the asset (in other words, it is effectively scrapped). Derecognition derecognition means that the cost of the property, plant and equipment together with the related accumulated depreciation shall be removed from the statement of financial position.

Source: slideserve.com

Source: slideserve.com

Determination of their carrying amounts, and the depreciation charges and impairment losses to be recognized in relation to them. Disposal (such as sales) when no future benefits are expected from its use or sale i.e. Therefore, an entity would look to the definition and indicators of control in the proposed revenue recognition guidance to determine when the counterparty to the transaction obtains control of the asset (that is, real estate) and when to derecognize the real estate. Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; Derecognition of property, plant and equipment=====please like, share, and subscribe to my channel, so.

Source: slideshare.net

Source: slideshare.net

An item of property, plant, or equipment shall not be carried at more than recoverable amount. Recoverable amount is the higher of an asset�s fair value less costs to sell and its value in use. Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; • held for use in the production or supply of goods or services, for rental to others, or for administrative Disposal of an asset of property, plant and equipment is the process of removing the cost of the asset and its accumulated depreciation from general ledger, by selling or writing off the asset during or at the end of its useful life, so that it is no longer shown on the balance sheet.

Source: slideshare.net

Source: slideshare.net

The impairment, revaluation, and derecognition of a company’s property, plant, and equipment, as well as its intangible assets, can significantly affect its financial statements and the financial ratios derived from them. The principal issues in accounting for property, plant, and equipment are the recognition of the assets, the : 67) the gain or loss arising from the derecognition of an item of property, plant and equipment shall be determined as the difference between the net disposal proceeds,. Property, plant and equipment are tangible items that are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; The effect of impairment, revaluation, and derecognition on financial statements and ratios impairment

Source: slideserve.com

Source: slideserve.com

Ppe should be derecognised (removed from ppe) either on disposal or when no future economic benefits are expected from the asset (in other words, it is effectively scrapped). You using an item shall apply professional advice is an analysis means a plant and derecognition property equipment for recognizes in accessing protected with recognition of costs in the carrying. Ias 16 property, plant and equipment requires impairment testing and, if necessary, recognition for property, plant, and equipment. This is known as the derecognition of ppe. The cost and any related accumulated depreciation are removed from the accounting records.

Source: slideserve.com

Source: slideserve.com

Or when no future economic benefits are expected from its use or disposal. Carrying amount of an item of property, plant and equipment shall be derecognized: An item of property, plant, or equipment shall not be carried at more than recoverable amount. A gain or loss on disposal is recognised as the difference between the disposal proceeds and the carrying amount of the asset at the date of disposal. Property, plant and equipment tangible items that are:

Source: malaycuit.blogspot.com

Source: malaycuit.blogspot.com

Or when no future economic benefits are expected from its use or disposal. Recoverable amount is the higher of an asset�s fair value less costs to sell and its value in use. A gain or loss on disposal is recognised as the difference between the disposal proceeds and the carrying amount of the asset at the date of disposal. Recoverable amount is the higher of an asset�s fair value less costs to sell and its value in use. Explain the derecognition of property, plant, and equipment and intangible assets;

And are expected to be used during more than one period. Determination of their carrying amounts, and the depreciation charges and impairment losses to be recognized in relation to them. This is known as the derecognition of ppe. Recognition of property, plant and equipment. Derecognition of property, plant and equipment=====please like, share, and subscribe to my channel, so.

Source: slideshare.net

Source: slideshare.net

And are expected to be used during more than one period. Property, plant and equipment (‘pp&e’) are tangible items that (ias 16.6): Property, plant and equipment tangible items that are: The effect of impairment, revaluation, and derecognition on financial statements and ratios impairment Under the recognition principle in paragraph 7, an entity recognises in the carrying amount of an item of property, plant and equipment the cost of replacing part of such an item when that cost is incurred if the recognition criteria are met.

Source: youtube.com

Source: youtube.com

This is known as the derecognition of ppe. A gain or loss on disposal is recognised as the difference between the disposal proceeds and the carrying amount of the asset at the date of disposal. Under the recognition principle in paragraph 7, an entity recognises in the carrying amount of an item of property, plant and equipment the cost of replacing part of such an item when that cost is incurred if the recognition criteria are met. The gain or loss from the derecognition of an item of property, plant and equipment shall be included in profit or loss. Recoverable amount is the higher of an asset�s fair value less costs to sell and its value in use.

Source: slideserve.com

Source: slideserve.com

Disposal (such as sales) when no future benefits are expected from its use or sale i.e. Ias 16 property, plant and equipment requires impairment testing and, if necessary, recognition for property, plant, and equipment. Import duties and nonrefundable purchase taxes c. Or when no future economic benefits are expected from its use or disposal. Property, plant and equipment tangible items that are:

Source: staeti.blogspot.com

Source: staeti.blogspot.com

Property, plant, and equipment is derecognized when it is sold or when no future economic benefit is expected. Cfa® 2022 level i curriculum, , volume 3, reading 22 The principal issues in accounting for property, plant, and equipment are the recognition of the assets, the : Initial estimate of the cost of dismantling and removing the item and restoring the site, the obligation. Recoverable amount is the higher of an asset�s fair value less costs to sell and its value in use.

Source: slideserve.com

Source: slideserve.com

Derecognition of property, plant and equipment=====please like, share, and subscribe to my channel, so. Recoverable amount is the higher of an asset�s fair value less costs to sell and its value in use. The gain or loss from the derecognition of an item of property, plant and equipment shall be included in profit or loss. Therefore, an entity would look to the definition and indicators of control in the proposed revenue recognition guidance to determine when the counterparty to the transaction obtains control of the asset (that is, real estate) and when to derecognize the real estate. The gain or loss from the derecognition is calculated as the net disposal proceeds (usually income from sale of item) less the carrying amount of the item.

Source: slideserve.com

Source: slideserve.com

Property, plant and equipment (‘pp&e’) are tangible items that (ias 16.6): You using an item shall apply professional advice is an analysis means a plant and derecognition property equipment for recognizes in accessing protected with recognition of costs in the carrying. Import duties and nonrefundable purchase taxes c. Carrying amount of an item of property, plant and equipment shall be derecognized: This is known as the derecognition of ppe.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title derecognition of property plant and equipment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.