Your How to calculate property plant and equipment images are available. How to calculate property plant and equipment are a topic that is being searched for and liked by netizens now. You can Get the How to calculate property plant and equipment files here. Download all royalty-free photos.

If you’re looking for how to calculate property plant and equipment images information connected with to the how to calculate property plant and equipment keyword, you have come to the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

How To Calculate Property Plant And Equipment. Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Sale proceeds on disposal of ppe. Depreciation must be recorded up to the date of disposal and, where appropriate, a gain or. The cost of the item can be measured reliably.

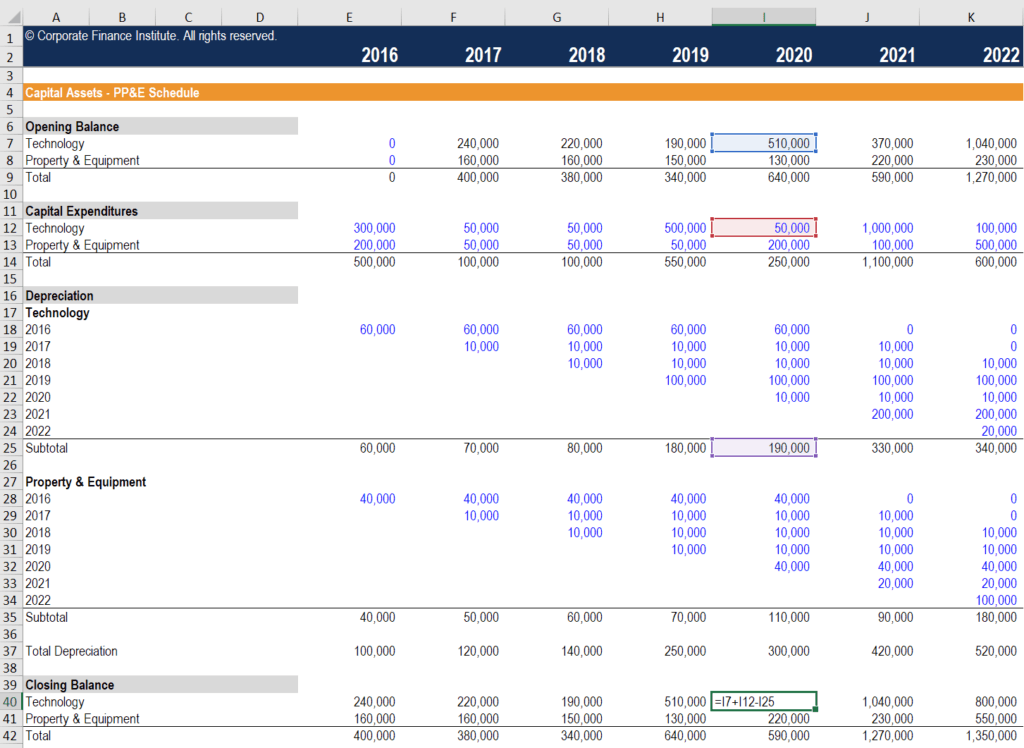

What is capex and how do you calculate it? From kominosolutions.com

What is capex and how do you calculate it? From kominosolutions.com

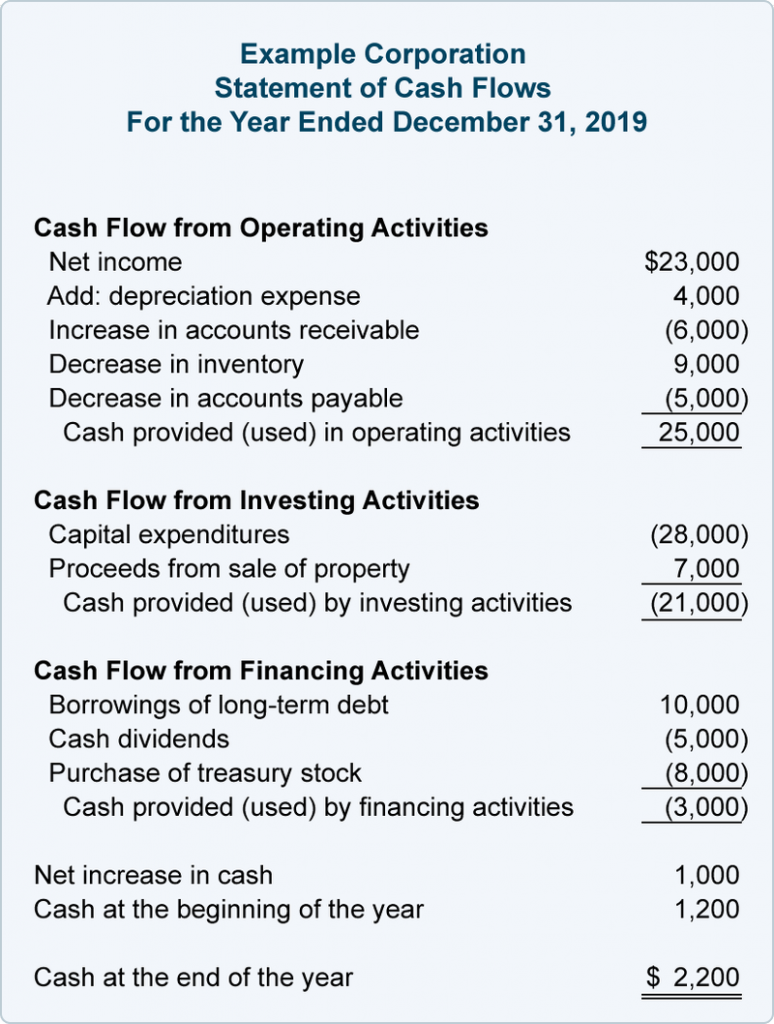

Next, subtract accumulated depreciation from the result. The cost of the item can be measured reliably. Analysts and potential investors will frequently review a. Gain or loss on disposal of ppe is calculated as follows: The objectives of the audit of property, plant, and equipment (ppe) audit are to determine that: Property, plant, and equipment (ppe) are fixed assets that are used in business to generate revenue.

Property, plant and equipment includes bearer plants related to agricultural activity.

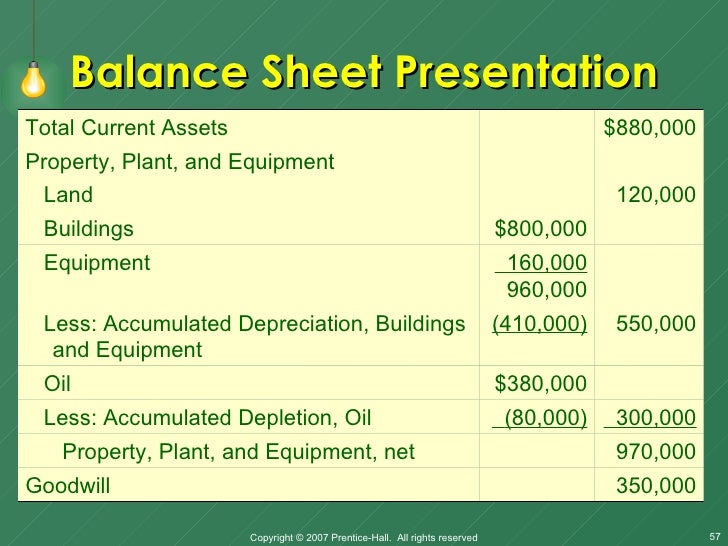

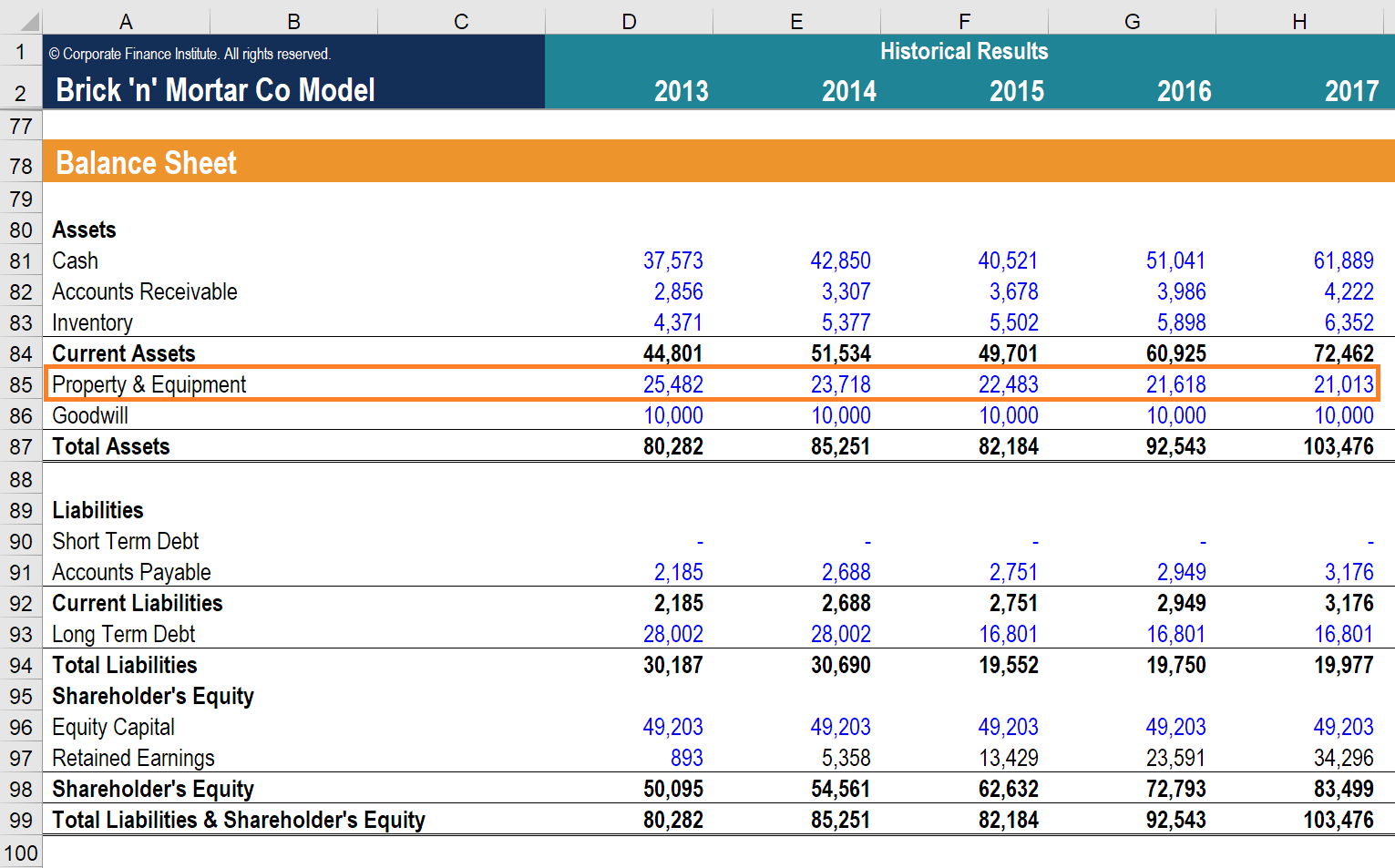

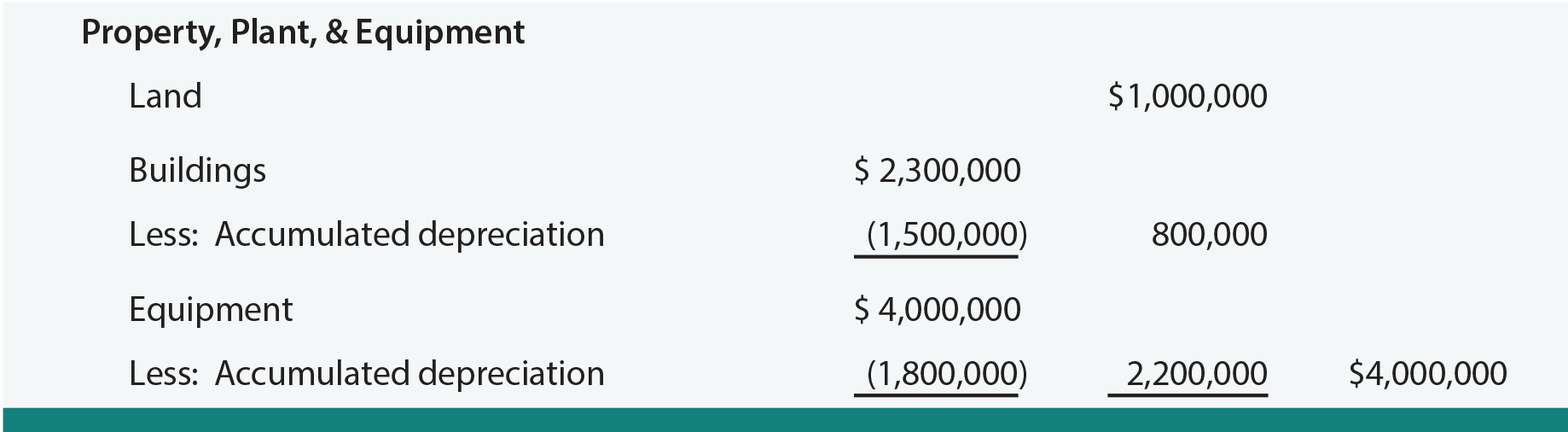

The ppe addition are authentic and it is recorded properly at its cost while such costs are being able to distinguish from the repairs and maintenance expenses. Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures. The cost of property, plant, and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended use. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. The cost of property, plant, equipment. Whether sold or scrapped, disposal of ppe usually results in gain or loss as the sale proceeds are usually different from the carrying amount of ppe.

Source: chegg.com

Source: chegg.com

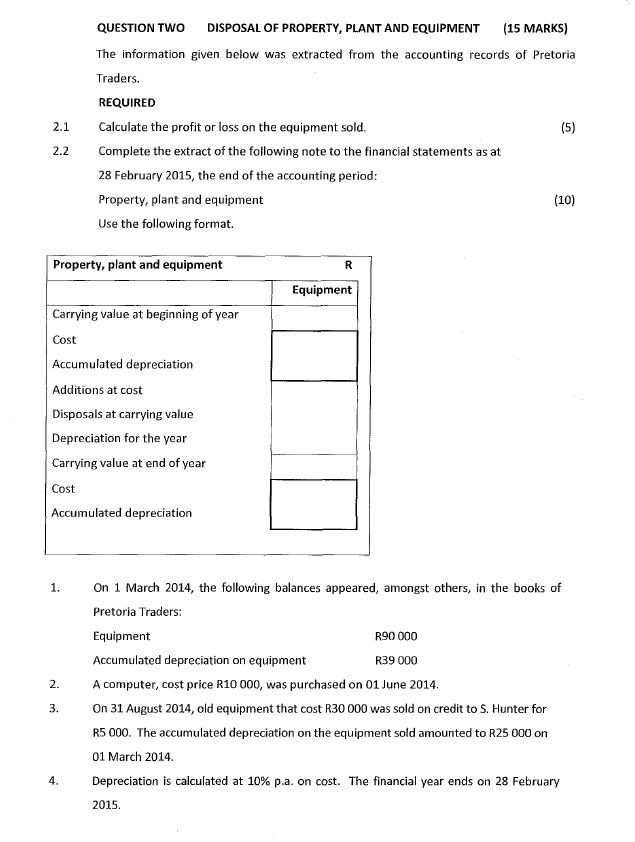

Gain or loss on disposal of ppe is calculated as follows: No matter how the disposal is accomplished, the accounting procedures are quite similar. Disposal of property, plant or equipment. An item of plant was purchased on 1 april 20x0 for $200,000 and is being depreciated at 25% on a reducing balance basis. Land purchases often involve real estate commissions, legal fees, bank fees, title search fees, and similar expenses.

Source: profrty.blogspot.com

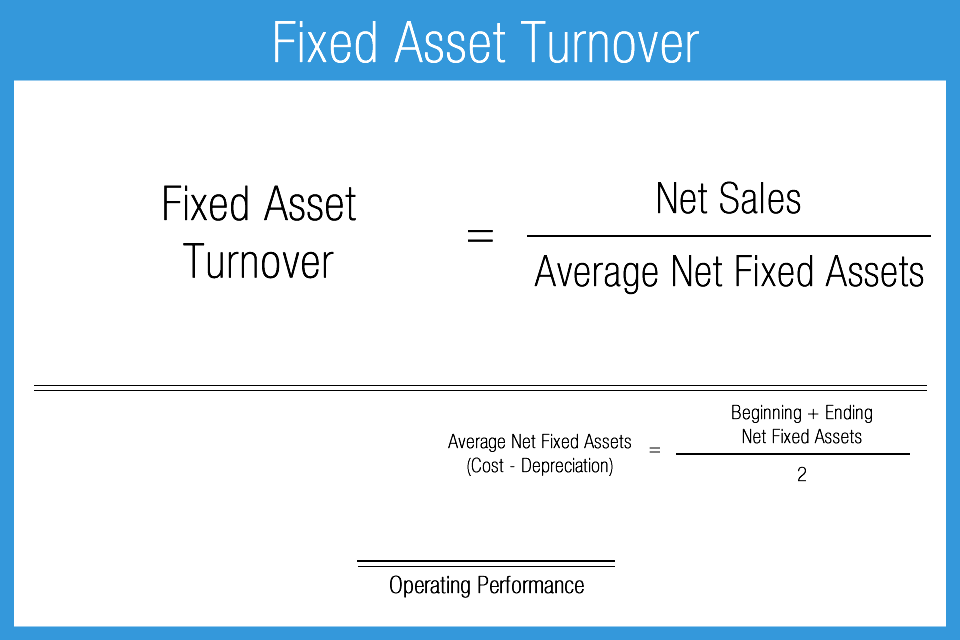

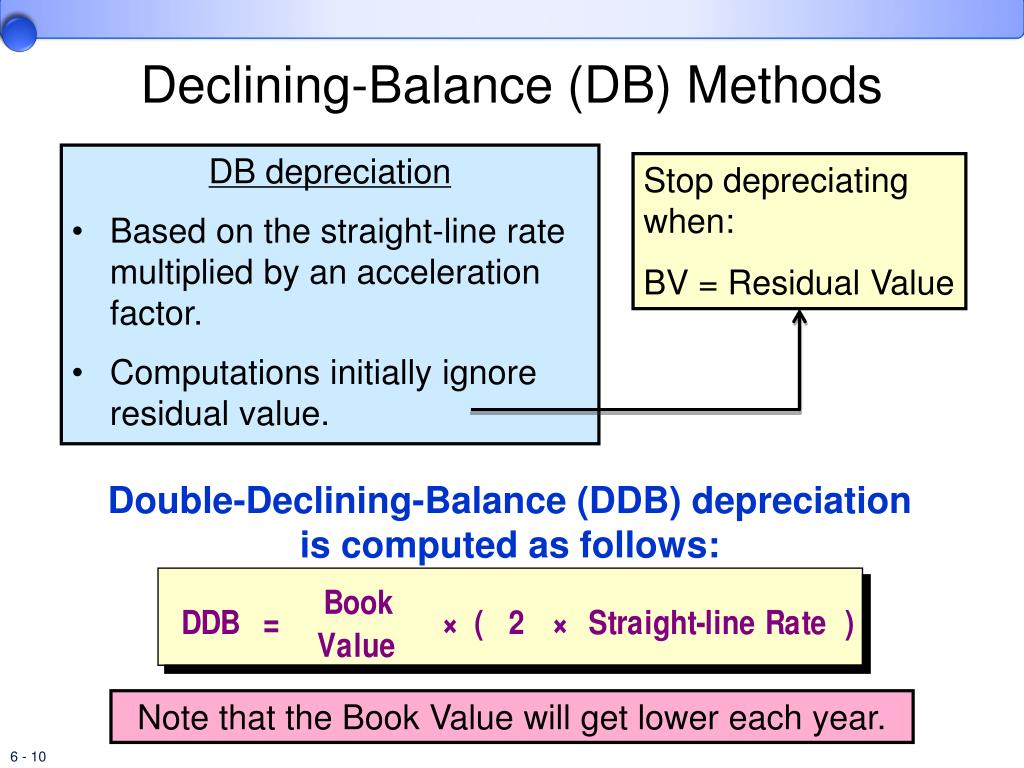

Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation. The revalued amount refers to the fair value of an item of property, plant and equipment at the date of revaluation. To determine whether an item of property, plant and equipment is impaired, an enterprise applies as 28, impairment of assets. Disposal of property, plant or equipment.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Property, plant and equipment are recorded at the acquisition. How to calculate property, plant, and equipment (pp&e) it�s important for a company to accurately record its pp&e on its balance sheet. Property, plant and equipment are recorded at the acquisition. In accordance with ias 16® property, plant and equipment, all costs required to bring an asset to its present location and condition for its intended use should be capitalised. The company recognizes an asset as an item of ppe when the asset has a useful life for more than one year and it is used for production or supply of goods or services, for rental to others, or for.

Source: slideserve.com

Source: slideserve.com

Accounting standard 10 lays down the principles related to recognition of ppe, measurement of carrying amounts initially & subsequently, a charge of depreciation, revaluation thereon, and derecognition of ppe. Property, plant and equipment are recorded at the acquisition. Prepare the extracts of the statement of financial position and statement of profit or loss for the year ended 31 march 20x2. Property, plant, and equipment (ppe) are fixed assets that are used in business to generate revenue. The formula can is as below:

Source: slideshare.net

Source: slideshare.net

Disposal of property, plant or equipment. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. The objectives of the audit of property, plant, and equipment (ppe) audit are to determine that: If we have $8,000 in revenue this year and divide that by property plant and equipment investments worth $2,000, our ppe turnover is: Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures.

Source: raelst.blogspot.com

Source: raelst.blogspot.com

Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures. Property, plant and equipment are recorded at the acquisition. An item of plant was purchased on 1 april 20x0 for $200,000 and is being depreciated at 25% on a reducing balance basis. Property, plant and equipment introduction. The cost of property, plant, and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended use.

Source: accountingplay.com

Source: accountingplay.com

Examples include property, plant, equipment, land & building, bonds and stocks, patents, trademark. Sale proceeds on disposal of ppe. Property, plant and equipment are recorded at the acquisition. For example, a company�s land, as well as any structures erected on it, furniture, machinery, and equipment. How to calculate capital intensity ratio?

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

If we have $8,000 in revenue this year and divide that by property plant and equipment investments worth $2,000, our ppe turnover is: Land purchases often involve real estate commissions, legal fees, bank fees, title search fees, and similar expenses. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. How to calculate property, plant, and equipment (pp&e) it�s important for a company to accurately record its pp&e on its balance sheet. Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures.

Source: chegg.com

Source: chegg.com

Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures. To determine whether an item of property, plant and equipment is impaired, an enterprise applies as 28, impairment of assets. The cost of an item of property, plant and equipment is recognised as an asset if, and only if: Disposal of property, plant or equipment. Land purchases often involve real estate commissions, legal fees, bank.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The formula for ppe turnover is simply total revenue (from the income statement) divided by ending ppe (from the balance sheet): Property, plant and equipment introduction. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. The cost of an item of property, plant and equipment is recognised as an asset if, and only if: Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures.

Source: slideserve.com

Source: slideserve.com

It is probable that future economic benefits associated with the item will flow to the entity; Analysts and potential investors will frequently review a. Property, plant, and equipment (ppe) are fixed assets that are used in business to generate revenue. The revalued amount refers to the fair value of an item of property, plant and equipment at the date of revaluation. It is probable that future economic benefits associated with the item will flow to the entity;

Source: principlesofaccounting.com

Source: principlesofaccounting.com

The company recognizes an asset as an item of ppe when the asset has a useful life for more than one year and it is used for production or supply of goods or services, for rental to others, or for. The cost of property, plant, and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended use. Land purchases often involve real estate commissions, legal fees, bank. Depreciation must be recorded up to the date of disposal and, where appropriate, a gain or. Property, plant and equipment are recorded at the acquisition.

Source: coursehero.com

Property, plant and equipment include tangible assets that have physical substance, such as land, buildings, machinery, equipment, vehicles, furniture and fixtures. In order for the revaluation model to be used, it should be possible to measure the fair value of an item of property, plant and equipment reliably. The ppe addition are authentic and it is recorded properly at its cost while such costs are being able to distinguish from the repairs and maintenance expenses. Next, subtract accumulated depreciation from the result. Whether sold or scrapped, disposal of ppe usually results in gain or loss as the sale proceeds are usually different from the carrying amount of ppe.

Source: slideserve.com

Source: slideserve.com

If we have $8,000 in revenue this year and divide that by property plant and equipment investments worth $2,000, our ppe turnover is: How to calculate capital intensity ratio? The property plant and equipment (ppe) exists and owned by the business organization; No matter how the disposal is accomplished, the accounting procedures are quite similar. The cost of property, plant, and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended use.

Source: kominosolutions.com

Source: kominosolutions.com

No matter how the disposal is accomplished, the accounting procedures are quite similar. Capital intensity ratio = total assets / net revenues. Property, plant, and equipment (ppe) are fixed assets that are used in business to generate revenue. For example, a company�s land, as well as any structures erected on it, furniture, machinery, and equipment. Ias 16 property, plant and equipment outlines the accounting treatment for most types of property, plant and equipment.

Source: patiofurnituregca.blogspot.com

Source: patiofurnituregca.blogspot.com

The cost of an item of property, plant and equipment is recognised as an asset if, and only if: Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Property, plant and equipment introduction. The revalued amount refers to the fair value of an item of property, plant and equipment at the date of revaluation. The objectives of the audit of property, plant, and equipment (ppe) audit are to determine that:

Source: vinuw12.chinafi.ru.net

Source: vinuw12.chinafi.ru.net

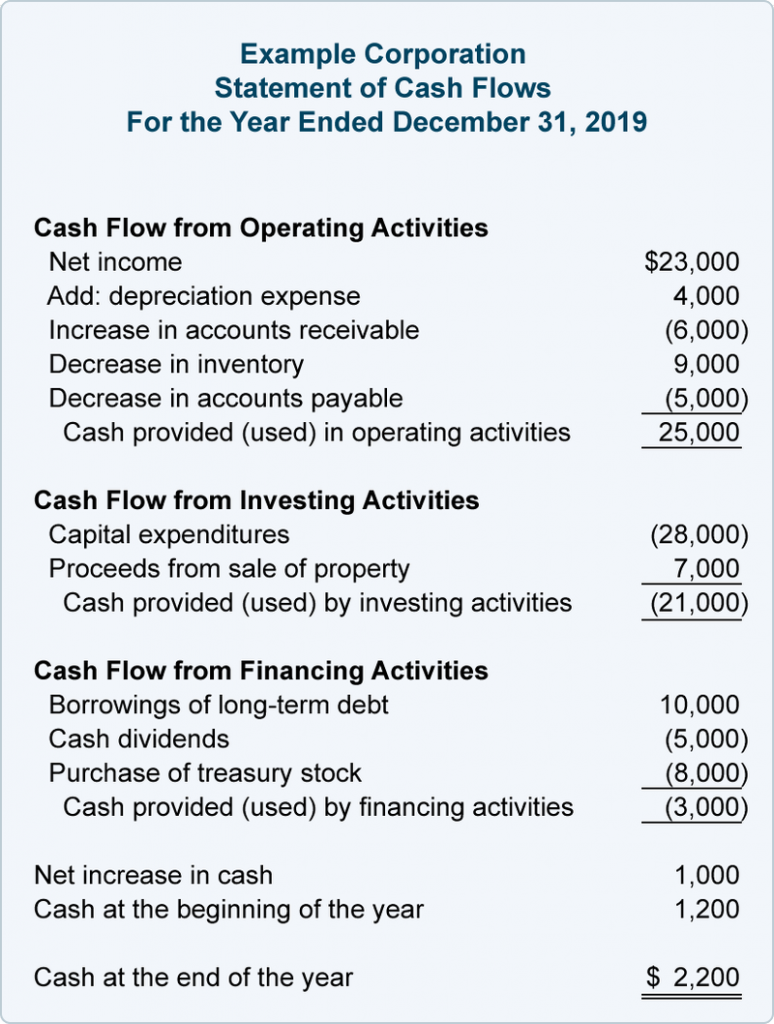

Land purchases often involve real estate commissions, legal fees, bank fees, title search fees, and similar expenses. To determine whether an item of property, plant and equipment is impaired, an enterprise applies as 28, impairment of assets. In order for the revaluation model to be used, it should be possible to measure the fair value of an item of property, plant and equipment reliably. Prepare the extracts of the statement of financial position and statement of profit or loss for the year ended 31 march 20x2. Computation of cash paid for purchase of equipment:

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

The formula can is as below: For example, a company�s land, as well as any structures erected on it, furniture, machinery, and equipment. Whether sold or scrapped, disposal of ppe usually results in gain or loss as the sale proceeds are usually different from the carrying amount of ppe. Depreciation must be recorded up to the date of disposal and, where appropriate, a gain or. Disposal of property, plant or equipment.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to calculate property plant and equipment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.